In the world of trading, identifying stocks with high growth potential and unique market positions is paramount. Monday.com, trading under the ticker $MNDY on NASDAQ, stands out as one of those stocks that demand attention. Its impressive growth trend, coupled with a strategic approach to scaling, makes it a compelling candidate for traders seeking volatile opportunities with substantial upside potential. In this article, we’ll delve into the reasons why Monday.com is topping my watchlist and explore the financial metrics that underscore its investment allure.

Growth Amidst Uncertainty: Monday.com’s Financial Overview

Despite the prevailing global uncertainties, Monday.com has managed to surpass expectations, illustrating resilience and strategic acumen. The company reported a remarkable 41% revenue growth in Fiscal Year (FY) 2023, a testament to its strong customer acquisition and expansion strategies. Let’s break down the financial highlights that paint a picture of Monday.com’s promising outlook:

Record-Breaking Financial Performance in FY 2023

- Q4 ’23 Revenue: Monday.com’s revenue for the fourth quarter of 2023 reached $202.6 million, marking a 35% increase compared to the same quarter the previous year. This growth is indicative of the company’s ability to continuously attract and retain customers.

- FY ’23 Total Revenue: The total revenue for FY 2023 was $729.7 million, up by 41% from the previous year. Such a significant year-over-year increase underscores the company’s expanding market presence and product adoption.

- Gross Margin and Efficiency: The company achieved a 90% gross margin in Q4 ’23 and anticipates maintaining high 80s in the medium to long term. This high margin reflects the company’s operational efficiency and the scalability of its business model.

- Free Cash Flow: In Q4 ’23, Monday.com reported a free cash flow of $55.4 million, with a free cash flow margin of 27%. For FY ’23, the free cash flow stood at $204.9 million, maintaining a high margin of 28%. These figures highlight the company’s strong cash generation capabilities.

Forward-Looking Projections: FY 2024

Looking ahead, Monday.com has set ambitious targets for FY 2024 that reflect its confidence in sustained growth:

- Q1 FY 2024 Revenue Forecast: The company expects its revenue to be between $207 million to $211 million, indicating a year-over-year growth of 28% to 30%.

- Operating Income and Margin: The projected non-GAAP operating income for Q1 FY 2024 ranges from $8 million to $12 million, with an expected operating margin of 4% to 6%.

- Free Cash Flow: For Q1 FY 2024, the anticipated free cash flow is between $56 million to $60 million, translating to a margin of 27% to 29%.

- Full Year 2024 Projections: The revenue projection for the entire year is set between $926 million to $932 million, showcasing a year-over-year increase of 27% to 28%. The non-GAAP operating income is expected to be between $58 million to $64 million, with an operating margin of 6% to 7%. The predicted full-year free cash flow ranges from $200 million to $206 million, with an estimated margin of approximately 22%.

The Technical Perspective: Monday.com’s Chart Analysis

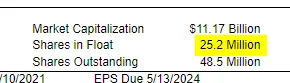

From a technical standpoint, Monday.com’s stock chart presents an enticing setup. The price action has been trading sideways for nearly six weeks, but it is now nearing a pivotal breakout point at the $231 level. This consolidation phase, followed by a potential breakout, signals a bullish momentum that could attract a significant influx of buyers, especially considering the stock’s lower float and rapid fundamental growth. Traders should closely monitor this level, as a move above $231 could catalyze a substantial price surge, presenting a lucrative entry point for those looking to capitalize on Monday.com’s upward trajectory.

Why Monday.com Stands Out

Monday.com’s ability to consistently surpass growth expectations, even amid global uncertainties, speaks volumes about its robust business model and market positioning. The company’s record-breaking financial performance, coupled with its strategic outlook for FY 2024, positions it as a standout stock in the tech sector. Moreover, the attractive technical setup on its chart adds another layer of appeal for traders seeking stocks with breakout potential.

The bottom line is Monday.com [NASDAQ: MNDY] is a stock that warrants close attention from traders in 2024. Its impressive financial growth, strategic foresight, and promising technical indicators make it a compelling opportunity for those looking to diversify their portfolios with a high-growth tech stock. Whether you’re a seasoned trader or new to the market, Monday.com offers a blend of volatility and growth potential that is hard to ignore.

This stock was a featured stock at Lusso’s News Insider’s VIP Program.

The lead writer and trader of Lusso’s News Insider is currently long Monday.com for a swing trade.

You can subscribe to Lusso’s News Insider here: Powerhouse.substack.com