Investment Overview

The travel and leisure industry has long been a barometer of consumer confidence and economic health. Post-pandemic, this sector is not just rebounding; it’s redefining the parameters of growth and investment potential. Investors seeking opportunities in this space often employ the CANSLIM methodology, a system based on a blend of quantitative and qualitative factors that gauge a company’s future prospects. CANSLIM stands for Current Earnings, Annual Earnings, New, Supply and Demand, Leader or Laggard, Institutional Sponsorship, and Market Direction. When applied to the travel and leisure sector, this methodology not only identifies promising stocks but also captures the prevailing sentiment and trajectory of the industry.

Industry Resurgence

As the world emerges from the constraints of the global health crisis, the pent-up demand for travel and leisure activities has propelled a robust recovery and growth phase. The resurgence is fueled by an appetite for experiential spending, rejuvenated global mobility, and a shift towards digital and sustainable tourism. Companies that adapted swiftly to the changing landscape by innovating customer experiences, leveraging technology, and expanding their global footprint are now at the forefront of the industry’s resurgence.

The CANSLIM Perspective

Through the lens of CANSLIM, this report will scrutinize two key players in the industry—Royal Caribbean Cruises (RCL) and Trip.com Group Limited (TCOM). Both entities have demonstrated strong quarterly and annual earnings growth, introduced new products and services, and witnessed favorable supply and demand dynamics. As leaders in their respective markets with substantial institutional sponsorship, their performances offer insights into the broader industry’s strengths and the market direction.

In the following sections, we will discuss the specifics of each company’s performance, strategies, and outlooks, providing a comprehensive analysis that reflects the vibrancy and potential of the travel and leisure industry in a post-pandemic world.

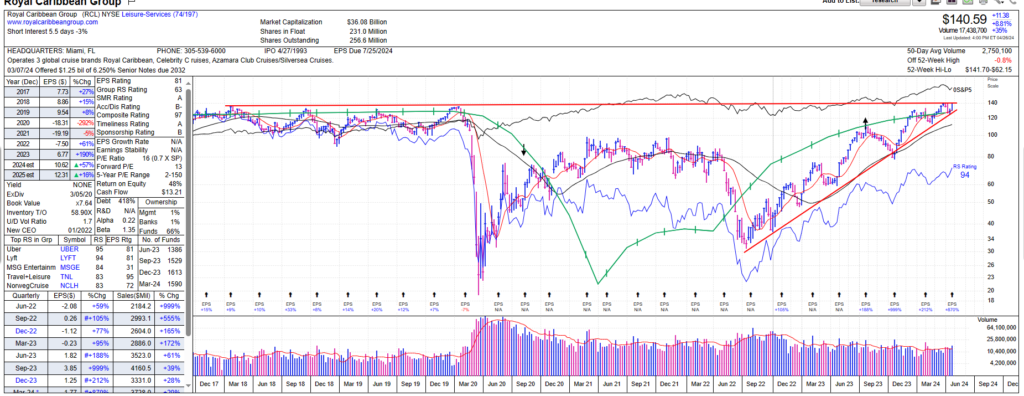

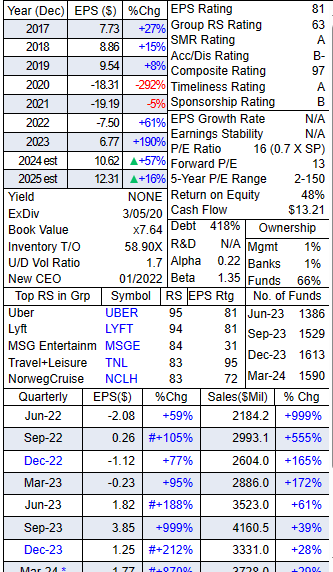

Research Report: Royal Caribbean Cruises (RCL)

Executive Summary

Royal Caribbean Cruises has reported a stellar performance in the first quarter of 2024, surpassing expectations set by management and analysts alike. As the travel and leisure industry continues its recovery trajectory post-pandemic, RCL has not only capitalized on this resurgence but has also strategically positioned itself to take advantage of the growing $1.9 trillion global vacation market.

CANSLIM Overview

- Current Quarterly Earnings: RCL reported adjusted earnings per share of $1.77, which is a 36% increase from the forecasted $1.30.

- Annual Earnings Growth: There has been a robust yield growth of 19.3% compared to the first quarter of 2023.

- New Product or Service: The introduction of the revolutionary Icon of the Seas has contributed to record-breaking bookings.

- Supply and Demand: Share supply may tighten as demand grows, indicated by increased bookings and 107% load factor.

- Leader or Laggard: RCL is outpacing the industry with strong demand across all key itineraries and destinations, notably in North America.

- Institutional Sponsorship: Institutional ownership is strong, with a noted increase in fund sponsorship.

- Market Direction: RCL is benefiting from a general upward market trend in the leisure and travel sector, with consumer spending on experiences doubling that of goods.

Strong Financial Performance

Royal Caribbean has successfully achieved a 107% load factor, and the demand environment continues to strengthen. The trifecta goals set by the company are now expected to be met in 2024, a year earlier than initially anticipated.

Expansion and Market Penetration

RCL’s expansion into the China market with Spectrum of the Seas and the planned addition of Ovation of the Seas in 2025 signifies the company’s confidence in and commitment to the Asia-Pacific region. In North America, the Caribbean itineraries, supported by new hardware like the Utopia of the Seas, are driving strong yield growth.

Strategic Innovations

The launch of private destinations such as the Royal Beach Club in Cozumel, Mexico, is enhancing guest experiences and is a pivotal element in competing against land-based vacations, potentially capturing a larger market share.

Focus on Sustainability

RCL’s sustainability efforts, highlighted in their 16th annual sustainability report, showcase their commitment to net-zero emissions and community impact, which is increasingly important to environmentally conscious travelers.

Technical Analysis

Referring to the image, RCL stock appears to be at a critical junction on the weekly chart, hovering around the $140 mark. The data suggests a pivotal area where the stock’s future price movement can be significantly influenced by upcoming trends and investor sentiment.

Conclusion

Given the robust quarterly results, strategic initiatives, and positive outlook shared in the earnings call, Royal Caribbean Cruises stands out as a compelling investment opportunity for CANSLIM traders. The company’s focus on delivering exceptional vacation experiences and its dedication to expanding its footprint in the global vacation market may bode well for its future stock performance.

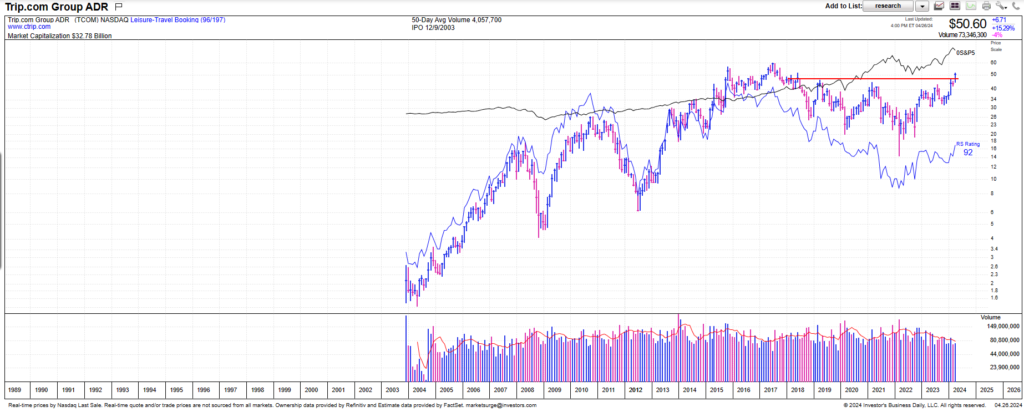

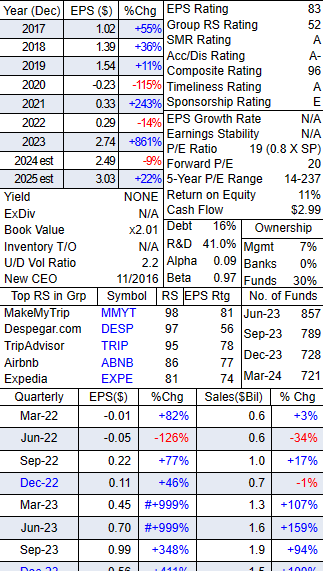

Research Report: Trip.com Group Limited (TCOM)

Executive Summary

Trip.com Group Limited (TCOM) has released its fourth quarter and full-year earnings for 2023, revealing substantial growth and robust recovery in the travel sector. The earnings call, led by Executive Chairman James Liang, CEO Jane Sun, and CFO Cindy Wang, highlighted a year marked by strategic expansions and customer-centric innovations. The company’s success is underpinned by the resurgence of China’s outbound travel and the strength of its global OTA platform. The company reports earnings again towards the end of May.

Overview and Financial Highlights

- Revenue Growth: Trip.com showcased a 105% year-over-year increase in Q4 2023 revenue, reaching RMB 10.3 billion. The full-year revenue was RMB 44.5 billion, a 122% increase year-over-year and 25% higher than 2019 levels.

- Market Segments Performance: All market segments, including domestic, outbound, and Trip.com’s global platform, reported robust growth with outbound travel bookings recovering to over 80% of pre-pandemic levels.

- Global Expansion: The OTA platform operates in 39 countries, focusing on Asian markets and expanding global offerings.

- Innovation and AI: Launch of TripGenie, an AI assistant, and investment in AI for improved customer service and operational efficiency.

- Sustainability Initiatives: Implementation of carbon hotel standards, green flights, and environmentally conscious travel options.

Financial Analysis

- Adjusted EBITDA Margin: A significant improvement to 31% in 2023, the highest in a decade, indicative of effective cost optimization.

- Profitability: Diluted earnings per ordinary share and per ADS reached RMB 1.94, with non-GAAP figures at RMB 4 per ADS, showcasing strong profitability.

- Capital Returns: The company commenced stock buybacks, demonstrating confidence in its valuation and long-term prospects.

TCOM Stock Technical Analysis

Referring to the provided image, TCOM stock appears to have recently crossed a crucial price level of $50. This breakout suggests a bullish sentiment among investors, likely driven by the company’s strong earnings and optimistic outlook for continued growth in the travel sector.

Strategic Initiatives

- Globalization: Aiming for 15-20% revenue contribution from Trip.com in the next 3-5 years, with a focus on direct traffic and cross-selling to enhance marketing efficiencies.

- Inbound Travel: Capitalizing on China’s visa-free policies to boost inbound travel, aligning with the government’s 14th five-year plan.

- Technology: Continuing to innovate with AI-driven solutions to improve user experience and streamline travel planning.

Outlook

Trip.com Group Limited is poised for accelerated growth in 2024, building on the upward trajectory in the global travel market. The company’s strategic focus on globalization, digitalization, and service quality positions it well to capitalize on the pent-up demand for travel and the evolving preferences of travelers.